There's a lot of speculation about what impact the current economy will have on PE and M&A activity in the healthcare industry. Will there be more consolidation? Less investment in new products and services? More focus on cost containment? What, pray tell, is the "current economy" anyway?

For predicting capital trends in healthcare, the S&P 500 is about as useful a metric as body mass index. When predicting the impact we'll see from the swirling currents of the Inflation Reduction Act, continuing (if slowing) inflation, and the worries about a contracting economy, a few trends do stand out, and many experts are predicting that private equity firms will be cautious in their investments in the next few years even in the traditionally recession-resistant healthcare space. In light of this, we've compiled a list of six trends to watch out for in 2023:

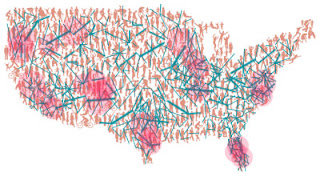

1. More Consolidation Among Healthcare Providers

With healthcare reform bringing so much change to the industry, many providers are looking to consolidate in order to remain competitive. This could lead to more M&A activity among hospitals, health systems, and other provider organizations. Almost every week we read about another major health player reporting a staggering loss. Consolidation is a common salve here, providing a broader footing and scale efficiencies.

2. Increased Focus on Cost Containment

As reimbursement rates continue to decline, investors will be looking for companies that can demonstrate a commitment to cost containment. Benefitting from medical practices and facilities that can still offer returns means finding the organizations that provide innovative solutions for driving down costs, and/or those that offer value-based care models.

3. Fewer New Healthcare Ventures Launching

With uncertainty around healthcare reform, we may see fewer new ventures launching in the space. This could mean less investment in areas like digital health and biotechnology.

4. More Investment in Services that Drive Revenue Growth

In order to offset declining reimbursement rates, investors will likely look for companies that can drive revenue growth through new services and offerings. This could include things like population health management or care coordination services.

5 . A Shift Away from Traditional Private Equity Investors

If traditional private equity firms become more cautious with their investments, we should see a shift towards strategic investors or venture capital firms moving more risk into the healthcare space. These investors are often more willing to invest in startups, emerging technologies, and other riskier investments, and may be less wary of higher interest rates in the market.

6. Continued Focus on Healthcare Consumers

Agile companies that have been successful in developing consumer-facing health technologies for established payers and providers, such as telemedicine, communication portals, remote monitoring, and "find-a-doctor" web applications, are likely to continue multiplying and expanding, driven by cost containment, care quality considerations, an aging population, and the growing market for faster, more immediate responsiveness to patient needs.

No one can dispute the existence of huge healthcare opportunities in a market that's getting older and more frail, and consuming unprecedented volumes of products and services. It remains to be seen exactly what investors will fund in healthcare this year, but one thing is certain: Profits will be made.